how are property taxes calculated in polk county florida

1932-1939 50 per 500. The median property tax in Polk County Florida is 1274 per year for a home worth the median value of 141900.

Property Taxes Monroe County Tax Collector

If the taxable value of your home is 75000.

. These are deducted from the assessed value to give the. The calculation is based on 160 per thousand with the first 500 being exempt. For comparison the median home value in Polk County is.

The median property tax also known as real estate tax in Polk County is 127400 per year based on a median home value of 14190000 and a median effective. 1940-1967 55 per 500 1st 100. Documents can be recorded in-person at any.

Use this Polk County Florida Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance. The Tax Collector also collects non-ad valorem assessments. Polk County Clerk of Court.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Enter your Home Price and Down Payment in the fields below. The average tax rate in Polk County is 09 of assessed home values which is just below the state average of 097.

Then payments are allocated to these taxing entities based on a predetermined payment schedule. In Polk County the average tax rate is 1461 per 1000. To confirm your calculation call Polk County Recording at 863-534-4000 option 7.

In addition to Polk County and districts such as schools many special districts like water and sewer treatment plants as. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Great wwwcopolkorusThe Polk County Assessors Office processes manufactured structure ownership applications as a partner and agent on behalf of the State of Oregons Department.

Based on average home prices you can anticipate paying an. The Tax Collector collects all ad valorem taxes levied in Polk County. Portland-area property taxes are high.

Checks should be made payable to. Real estate tax funds are the mainstay of local neighborhood budgets. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill.

How Property Tax is Calculated in Polk County Florida Polk County Florida property taxes are typically calculated as a percentage of the value of the taxable property. Polk County collects on average 09 of a propertys assessed fair market. In general there are three aspects to real property taxation.

Current Tax Rate. Led by Linn County actually pay a greater percentage of their homes value in property.

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

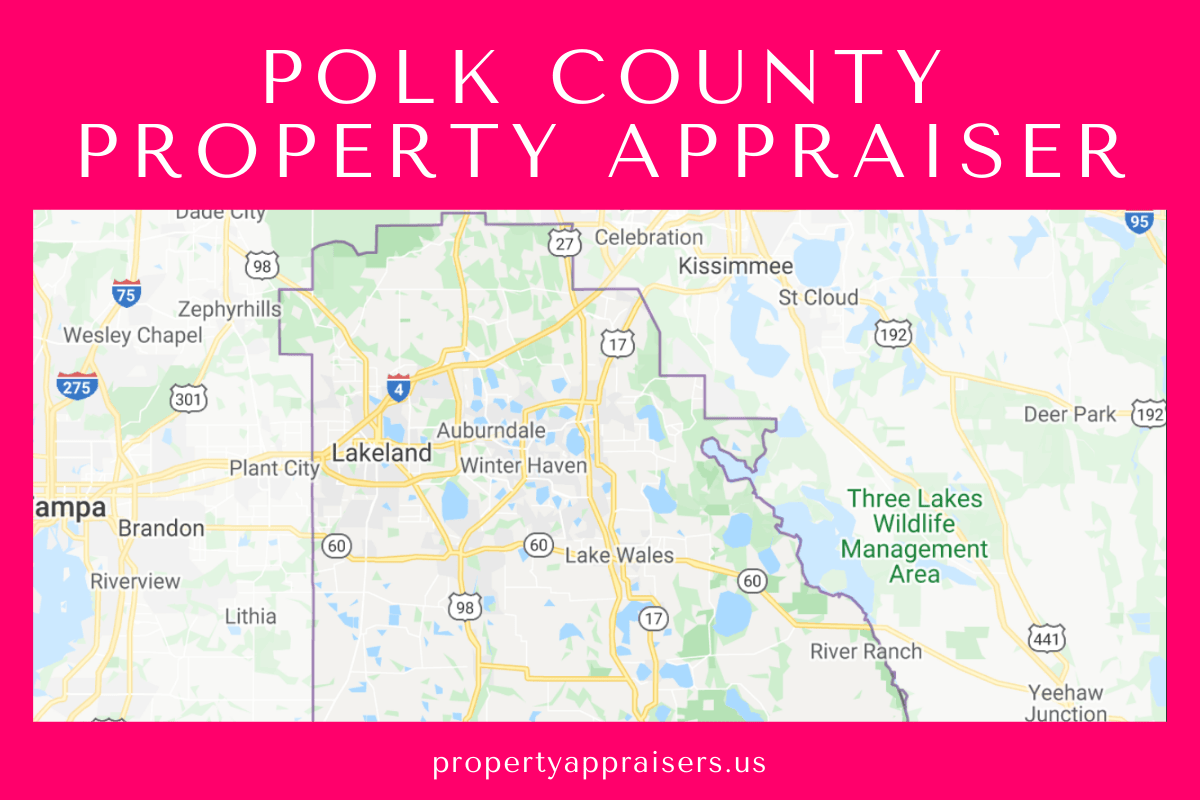

Polk County Property Appraiser Richr

Property Taxes Polk County Tax Collector

Homestead And Veterans Amendments On Smooth Road Toward Approval Florida Phoenix

Property Taxes Polk County Tax Collector

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

2022 Best Places To Buy A House In Polk County Fl Niche

Florida Property Tax H R Block

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

How Property Taxes Are Calculated On A New Home Moving Com

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

Polk County Fl Real Estate Polk County Fl Homes For Sale Zillow

Florida Property Tax Calculator Smartasset

What Is A Florida County Tourist Development Tax

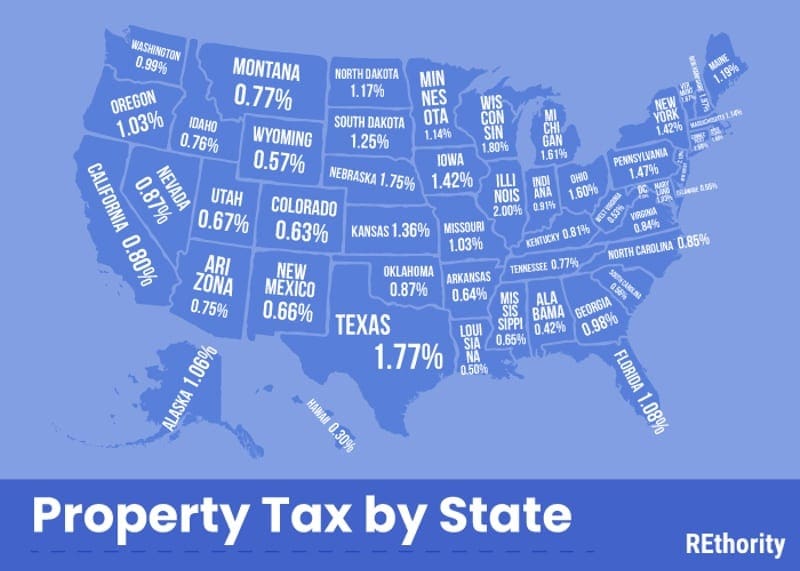

Property Tax By County Property Tax Calculator Rethority

Property Tax Estimator Tools By County

Polk County Property Appraiser How To Check Your Property S Value

Broward County Fl Property Tax Search And Records Propertyshark